“When you think about wages going up, when you think about inflation at its lowest by more than 50 percent than it was a year ago, that’s because of the work that this President has done. And he’s going to continue to focus on what we can do to lower cost for the American people. And so, that is incredibly important.”

That was White House Press Secretary Karine Jean-Pierre on June 26, outlining President Joe Biden’s views on the current state of the U.S. economy, which have seen a diminution of the purchasing power of American households as high inflation set in following the more than $6 trillion that was printed, borrowed and spent into existence for Covid coupled with the economic lockdowns and production halts—literally too much money chasing too few goods.

As a result, inflation rose from just 1.4 percent annualized in Jan. 2021 when Biden took office to 5.4 percent by June 2021, to 7.5 percent by Jan. 2022 right before Russia invaded Ukraine and peaking at 9.1 percent in June 2022 before it finally took its toll, the economy overheated, Americans maxed out their credit cards and demand began to sink.

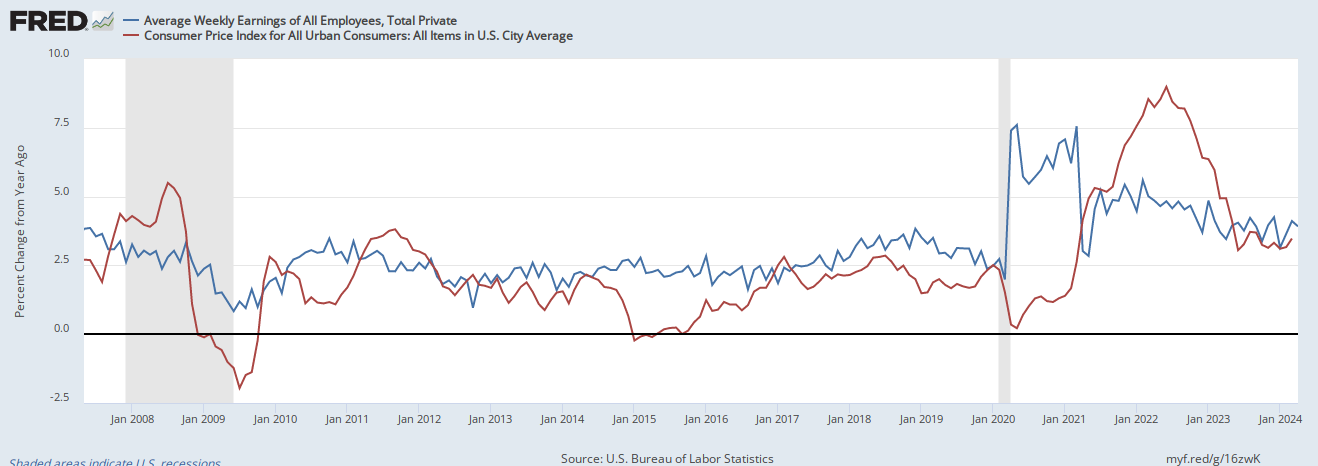

The worst part is that even with inflation down to 4 percent the past 12 months, prices are now permanently higher than they were, and as for wages those have simply not kept pace through the price hike, as consumer prices have grown much faster than nominal wages as measured by the Bureau of Labor Statistics.

In 2020, as 25 million Americans lost their jobs, particularly lower wage workers, “average” earnings actually increased, but only because so many people were laid off during the lockdowns. By the end of 2020, more than 16 million Americans had already returned to work, and the true damage left by Covid, the lockdowns and Congress’ spending spree were revealed.

In Jan. 2021, average weekly earnings were growing at 7.36 percent annualized, dropping to 4.55 percent in June 2021 as millions more reentered the labor force and staying down there at 4.8 percent by June 2022. Even now, as annualized inflation has slowed down to 4 percent currently, so too have wages, to 3.3 percent growth over the past twelve months.

Simply put, under “Bidenomics,”—a phrase the White House is actually touting—the American people are falling behind, even as Jean-Pierre tried to say they were not: “what we have seen, even before the pandemic, is we’ve seen Americans and American families being left behind.” But during the later Obama and Trump years, for the most part, nominal incomes were growing faster than prices. Now, it’s the opposite.

As Jean-Pierre acknowledged, “[Inflation] is still too high,” even as she tried to soften the blow, stating, “we know that the American people is dealing — they’re dealing with a lot. But what we believe is that we have — we have — we have done the work. And we have shown that inflation — inflation has indeed come down.”

But not by enough, by the White House’s own estimation. And it might not be over yet, with the Federal Reserve anticipating even more interest rate hikes may be in the offering going forward to deal with what has become quite sticky inflation, even as it has paused rate hikes in its most recent meeting, taking a wait and see approach. The global supply chain, particularly for energy and food, is still unstable and further supply shocks could send prices soaring again.

While on one hand that might point to a little life left in the economy—if prices again start rising during peak employment, it could point to a slightly longer cycle—on the other, if unemployment suddenly spikes then that could keep prices lower than they otherwise might be.

Unemployment is still near record lows, currently at 3.7 percent in May, but that’s up from 3.5 percent in April. And the Fed is projecting it to keep rise steadily to 4.1 percent this year and up to 4.5 percent in 2024, an implied 1.3 million jobs losses between then and now, as it sees inflation continuing to cool off from its current levels.

If so, then one of the hallmarks of Bidenomics will be a garden variety recession by 2024, which might not be the record President Biden really wants to run on for reelection. Time will tell. Stay tuned.

Original Article: https://dailytorch.com/2023/06/bidenomics-are-leaving-americans-behind-with-permanently-higher-prices-interest-rates-and-a-lower-standard-of-living/