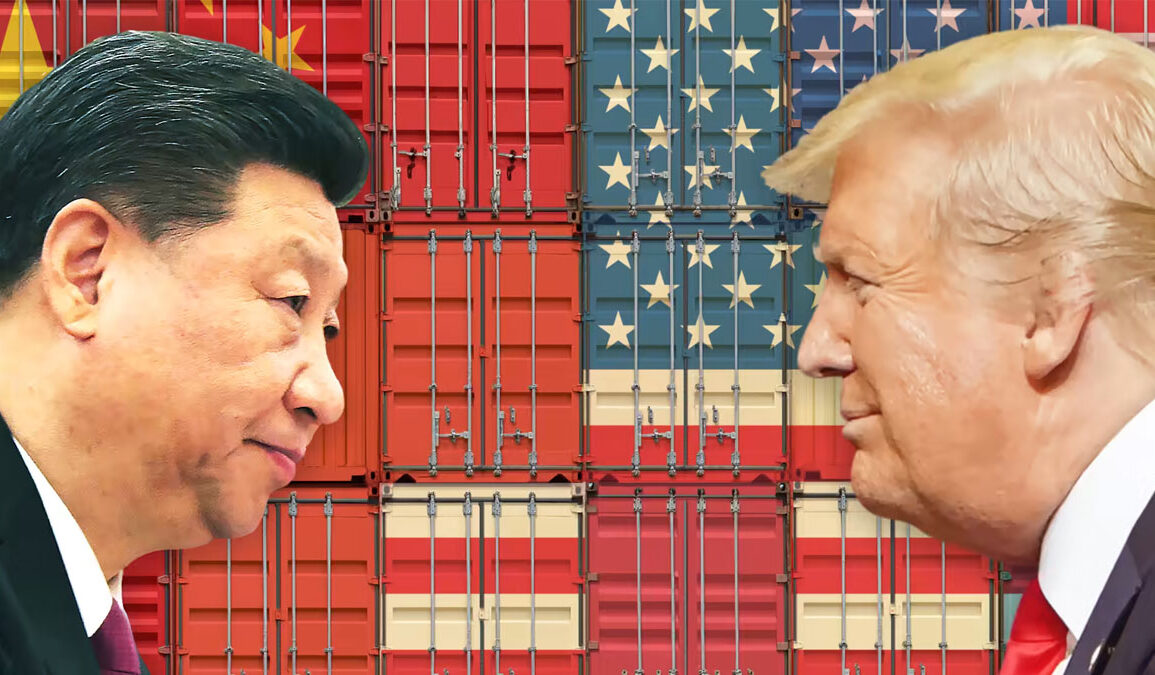

As Donald Trump prepares to take office for a second term, his bold stance on China is once again grabbing headlines. Trump, a vocal critic of China’s trade practices, has promised to confront Beijing head-on, using tariffs and other tools to level the economic playing field. While critics argue this approach risks escalation, Trump’s supporters see him as a champion of American workers and industries, determined to hold China accountable for years of unfair trade practices.

This article unpacks the strategies and counter-strategies in what could become a defining battle of Trump’s second presidency, focusing on his threats, China’s responses, and the possible outcomes.

Trump’s Plan: The Art of the Tariff

Donald Trump has made it clear that he is not afraid to take a hard line against China. His track record speaks for itself: during his first term, he raised tariffs on Chinese goods from 3% to 19%, affecting over $370 billion worth of imports. His goal was simple: to pressure Beijing into abandoning unfair practices, such as intellectual property theft and state-sponsored economic manipulation, that harm American businesses and workers.

Now, Trump is promising even more aggressive measures. His latest proposal includes a 10% tariff on all Chinese imports, with the possibility of increasing to as much as 60% on select goods. Trump has justified this bold move by highlighting the need to protect American manufacturing and reduce reliance on a country that has, in his words, “taken advantage of us for decades.”

These tariffs are not just about economics—they’re about holding China accountable on broader issues. For example, Trump has tied additional tariffs to efforts to stop the flow of fentanyl into the U.S., a drug he claims is “poisoning our communities” and “coming straight from China.”

China’s Countermoves: Fighting Fire with Fire

China, however, is not sitting idle. Having learned from the 2018 trade war, Beijing is employing a range of strategies to push back against Trump’s threats. Recognizing that it cannot match the U.S. dollar-for-dollar on tariffs—given that America imports roughly three times as much from China as it exports—China is targeting key vulnerabilities in the U.S. economy.

1. Export Controls on Critical Minerals

China recently announced restrictions on key materials like graphite, gallium, and germanium, which are essential for products ranging from semiconductors to defense equipment. By controlling over 90% of the global supply of some of these materials, Beijing hopes to hit industries that rely on them, sending a clear message to Washington.

2. Regulatory Pressure

Beijing has also turned to legal and regulatory tools to target American companies. A recent example is the antitrust investigation into Nvidia, a leading U.S. semiconductor company. This echoes earlier moves during Trump’s first term, such as China blocking the Qualcomm-NXP merger, a decision that undermined major U.S. business plans.

3. Financial Leverage

China’s ultimate weapon lies in its $1 trillion holdings of U.S. Treasury securities. While dumping these holdings outright would hurt both economies, even a partial selloff or a pause in purchasing could destabilize U.S. financial markets. Trump has dismissed this as a bluff, but some analysts warn it remains a “tail risk” in this high-stakes game.

Trump’s Critics Are Wrong About Dependency

Critics of Trump’s tariffs often argue that the U.S. relies too heavily on China, but Trump and his allies see this argument as fundamentally flawed. Yes, China supplies low-cost goods, but this relationship cuts both ways. As Yale economist Stephen Roach notes, “The U.S. is also heavily reliant on China for surplus saving to help fill its void of domestic saving, and U.S. producers rely on China as America’s third-largest export market.”

Trump’s position is clear: this codependency does not mean the U.S. should accept unfair trade practices. In fact, the data shows that Trump’s tariffs forced significant changes. While the Chinese share of the U.S. trade deficit dropped from 47% to 26% between 2018 and 2023, it also exposed the inefficiencies of globalization, as production shifted to higher-cost countries like Vietnam and Mexico.

“This is about fairness,” Trump has said. “We’re not asking for special treatment. We’re demanding equal treatment.”

Negotiation or Escalation: China’s Calculated Response

Despite Trump’s tough rhetoric, Beijing has signaled its willingness to negotiate. Analysts believe this is driven by China’s recognition of its own vulnerabilities. The Chinese economy, while dominant in some sectors, faces significant challenges, including slowing growth and weak domestic demand.

China’s strategy seems twofold: delay further tariffs through negotiation while strengthening its hand by targeting strategic U.S. industries. For example, China’s commerce ministry recently expressed openness to discussions, stating it is “ready to engage” with Trump’s team on trade and economic issues. This echoes Beijing’s approach during the first trade war, which culminated in the “Phase One” agreement where China agreed to purchase an additional $200 billion in U.S. goods.

However, China’s willingness to sit at the table doesn’t mean it will capitulate easily. Beijing has new bargaining chips, such as increased purchases of U.S. oil and natural gas, which align with Trump’s “Drill, baby, drill” energy agenda. At the same time, it has demonstrated it can retaliate if necessary, as shown by its recent moves against U.S. drone manufacturers and chipmakers.

What’s at Stake: The Outcomes of Trump’s Bold Approach

The Trump-China trade war has far-reaching implications for both nations—and the world. Here are the potential outcomes:

1. Prolonged Trade War

If negotiations stall, the result could be a prolonged economic conflict that disrupts global supply chains. While both nations would suffer, Trump believes America is better positioned to withstand the pain, citing its stronger economy and resilient industries.

2. Strategic Realignment

Both countries may accelerate efforts to reduce dependencies. For the U.S., this could mean bringing manufacturing back home or expanding trade with allies like India and Mexico. For China, it could involve investing in self-sufficiency, particularly in high-tech industries like semiconductors.

3. Negotiated Settlement

The most optimistic outcome is a negotiated deal that addresses Trump’s concerns while avoiding further escalation. Such a deal would require significant concessions from Beijing, including commitments to curb intellectual property theft and increase imports of U.S. goods.

4. Financial Turmoil

The worst-case scenario involves China using its financial leverage to destabilize U.S. markets. While Trump has downplayed this risk, it remains a wildcard that could have global repercussions.

The U.S.-China trade conflict is not merely a dispute over tariffs but a broader struggle for global dominance in technology, resources, and economic influence. Trump’s tariff threats and China’s calculated responses highlight the complexities of their interdependence. As both nations brace for the next chapter in their economic rivalry, the stakes have never been higher—for their citizens, their industries, and the global economy at large.

“China has played the long game for too long,” Trump has said. “It’s time we played to win.”