BRICS is a grouping of the world economies of Brazil, Russia, India, China, and South Africa formed by the 2010 addition of South Africa to the predecessor…

BRICS is a grouping of the world economies of Brazil, Russia, India, China, and South Africa formed by the 2010 addition of South Africa to the predecessor BRIC. The original acronym “BRIC”, or “the BRICs”, was coined in 2001 by Goldman Sachs economist Jim O’Neill to describe fast-growing economies that would collectively dominate the global economy by 2050. The BRICS have a combined estimated total population of about 3.2 billion, or around 42% of the global population.

The 15th annual BRICS summit took place this week in Johannesburg, South Africa, and was attended by the heads of state or heads of government of the five member states: Brazil, Russia, India, China, and South Africa. South African President Cyril Ramaphosa also invited the leaders of 67 countries to the summit. Several countries expressed interest in joining the BRICS group, and Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates were invited to join the bloc. Full membership will take effect on 1 January 2024. The debate over enlargement has topped the agenda at the summit, which could allow dozens of interested nations to seek admission as Beijing and Moscow push to forge it into a viable counterweight to the West.

BRICS has formally announced that they will be more than doubling the number of countries in their alliance by accepting six new nations. These are not small nations or insignificant moves, as most have traditionally been aligned with Western economic interests. Thus, we are seeing a major geopolitical shift take place this week that could have ripple effects for decades to come.

Let’s take a quick look at the nations joining the BRICS alliance.

Argentina has a long-running economic partnership with Western bodies including the IMF and World Bank. The IMF recently approved a$7.5 billion disbursement for Argentina, part of an existing 30-month, $44-billion program aimed at improving the dire economic situation. Argentina plans to use the disbursement to repay China part of the money it borrowed through a currency swap line. The World Bank has also approved two new projects for Argentina worth around $650 million. But the relationship between Argentina and these organizations has been somewhat adversarial or exploitative according to critics. So it is significant to see Argentina moving to join the BRICS alliance, which is seen as an alternative to Western economic groups.

Saudi Arabia is the de-facto OPEC+ leader and has been largely responsible for the US dollar having petrodollar status and strength over the past several decades. The rejection of the petro-dollar will lead to a large surplus of dollars in world trade that will not be used, causing massive inflation, especially in the US.

The United States government has been pressuring Saudi Arabia to continue pricing its oil sales in US dollars. Saudi Arabia originally agreed to do so in 1974, shortly after Nixon took the dollar off the gold standard, in exchange for the military protection of the United States.

The short version of the story is that the agreement created artificial demand for US Treasury bonds, debt and dollars. This was a major contributing factor to the dollar not crashing after losing convertibility to gold and remaining so strong in recent years despite the explosion of new dollar printed, soaring deficits and a US National Debt that is now nearing $33 trillion! Some are suggesting that the dollar is now dead, but we are more likely to see a slow, but accelerated, decline in the dollar’s dominance and value.

Some believe the Ukraine war is an attempt by the United States to save the dollar. But it appears that Russia is winning the war and likely to gain territory in any peace deal. And the war is pushing the military and economic superpowers of Russia and China even closer together. A defeat of Western ambitions in Ukraine is likely to add further pressure to the US dollar.

Egypt has received over $80 billion in U.S. foreign aid since 1978 and is seen as a strong ally of the United States. Total bilateral trade between the two nations is nearing $10 billion annually. Egypt is the United States’ largest export market in Africa, and American firms are active in most sectors of the Egyptian economy. So it is significant to see Egypt joining the BRICS alliance, which is likely to lead to a decline in trade relations with the West.

The United Arab Emirates (UAE) and the United States have had friendly relations since 1971 and have established formal diplomatic relations since 1972. The two countries have developed strong government-to-government ties, including close security cooperation. The UAE plays an influential role in the Middle East and is a key partner for the US. Bilateral trade has risen to $23 billion, and the UAE has participated in U.S.-led military operations in Kuwait, Afghanistan, Serbia, and Iraq as well as the NATO U.S.-led mission in Libya.

But the UAE decided to use Chinese technology in 2021, such as Huawei’s 5G telecommunications network, angering the United States. And while the move to join BRICS does not mean they are cutting off ties with the West, it is likely to lead to increased trade with BRICS nations and decreased trade with the United States. There is frustration in D.C. over the UAE’s role in enabling Russian business and capital to find a home from sanctions.

Iran moving to join BRICS is less controversial, as they have not been close allies of the United States or Western nations. But they have a GDP of $388 billion and are the world’s 21st largest nation by purchasing power. Their stock exchange has been one of the best performing over the past decade and they have 10% of the world’s provide oil reserves and 15% of gas reserves. They are an energy superpower and control strategically important land and waters in the Middle East. They have advanced military manufacturing, to the point that the US has asked them to stop selling their very effective drones to Russia.

Ethiopia is the second most populous country in Africa, remains an effective development partner, particularly in areas of health care, education, and food security. The United States has maintained diplomatic relations with Ethiopia since 1903 and is the largest bilateral donor in Ethiopia, providing an estimated $3.16 billion in humanitarian assistance since 2020. However in 2021 Ethiopia accused the United States of meddling in its affairs after Washington announced restrictions on economic and security assistance over alleged human rights abuses during the conflict in the northern Tigray region. This likely drove a wedge between the two nations and may have turned Ethiopia more enthusiastically toward the East.

BRICS to Control Over 80% of Global Oil Production and 33% of GDP

With the addition of Saudi Arabia, the United Arab Emirates and Iran to the BRICS, the Union will be able to control the lion’s share (over 80%) of the world’s oil production. BRICS nations are experiencing some of the fastest GDP growth and together amount to over $30 trillion in GDP.

The economic alliance that represented just 17% of GDP in 1995, now represents 32% of global GDP, surpassing G7 nations for the first time. This data was from April, but more recent numbers peg the BRICS share of global GDP at 33.5%. The BRICS alliance is now a force to be reckoned with and their growth is only getting started.

The Expanding BRICS Alliance is a Threat to the Dollar’s World Reserve Status

A staggering 40 countries have expressed interest in joining BRICS at the same time that African countries are kicking out imperial Western nations and flying flags of Russia. As Western hegemony dwindles, so will the value of the US dollar. This is partly blowback from historically heavy-handed US policies and fears from the dollar being weaponized against other nations. This has led to more and more countries converting out of dollars and into yuan and gold.

The United States and allies cut Russia off from the SWIFT payment system and froze over $350 billion of its gold and foreign exchange reserves. That type of economic warfare can massively reduce trust in the dollar-based monetary system, especially amongst countries in the Global South which have long been skeptical of US hegemony. If the US can do this to Russia, will they consider doing it to other nations that don’t toe the line? And do they really want to continue holding their reserves in the dollar?

BRICS nations have recently started dropping the dollar in bilateral trade in favor of the Chinese yuan or other local currencies. BRICS Pay offers a single payment system outside of the dollar, a cloud platform to connect national payment systems, financial messaging system, and a SWIFT replacement. Russia, China and Iran already have their own alternatives to SWITF, but BRICS is expecting a common system within the next six months.

The expansion of BRICS is going to further accelerate global de-dollarization. In fact, new BRICS entrant Iran made it clear this is part of their mission.

“Iran supports efforts of BRICS in de-dollarization.”

– Iranian President Ebrahim Raisi tells the BRICS summit

Put simply, there has never been a threat to the dollar’s supremacy as significant as this. Dominant reserve currencies have a life expectancy of around 100 years. The U.S dollar took the title officially in 1944 as part of the Bretton Woods Agreement, but many argue that this date should go as far back as the 1920s as the dollar was already the dominant global currency then. Thus, the U.S dollar is nearing its 100-year shelf life.

Could time be running out for the U.S. dollar? How much longer can the dollar keep its faltering stranglehold on world reserve status?

Stanley Druckenmiller, who is known for being a legendary investor thanks to his study of history and macroeconomics, believes the USD will lose reserve currency status within the next 15 years, stating:

“I can’t find any period in history where monetary and fiscal policy were this out of step with economic circumstances, not one.”

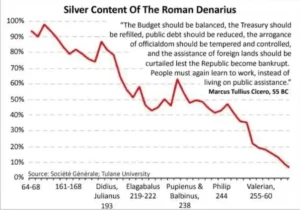

The key driver of the fall of the Roman empire was excessive money printing and inflation. Well, not technically “money printing,” but Roman leaders continually lowered the amount of silver in the Denarius coin that gave it value. This was done so that more coins could be pumped into circulation and the government could spend more growing their military and expanding their empire. This was their version of printing money and it is eerily similar to what is happening in the United States today. Those who do not read history are doomed to repeat it, and it appears our politicians and central bankers either don’t read or don’t care.

“The budget should be balanced, the treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and assistance to foreign lands should be curtailed lest Rome become bankrupt.”

– Marcus Tullius Cicero

Cicero’s words are more relevant than ever as the United States continues sending tens of billions to Ukraine to fight a proxy war against the world’s largest superpower. The U.S. also maintains over 750 military bases in over 80 countries, spending more on the military than the next 10 biggest countries combined. The US also provides over $50 billion in aid annually to a variety of nations, by far more foreign aid than anyone else. Even if you believe this aid is always altruistic (it isn’t), this does not change the fiscal irresponsibility of this scale of overseas spending.

This has been made possible by the privilege of being able to print infinite amounts of the world reserve currency. But this only works when the rest of the world wants dollars for reserves and trading. If they start using something else, demand for dollars drops significantly, and the value of the dollar will follow. Thus far we have only seen gradual declines in the value of the dollar over time, but that gradual pace could become significantly more rapid over the next few years.

Bitcoin and Gold-Backed Currencies Offer Sound Money Alternatives

There is a good reason central banks throughout the world last year bought the most gold on record since 1950, in an effort to combat rising inflation and financial instability. They are trading in un-backed paper currencies for scarce assets. Smart money knows the fragility of our monetary system and are preparing for its collapse. Central bank gold demand hit 228t in Q1 of this year, 34% higher than the previous Q1 record, set in 2013.

Whether the alternative to the US dollar will be the yuan, a BRICS currency, or another gold or asset-backed currency in the future, many nations are seeing that the current global reserve may be on the decline for good.

Some also speculate that Bitcoin could become an alternative to the dollar and new world reserve currency given its scarcity, ease of storage and transport, decentralization and growing acceptance globally. Bitcoin operates on a peer-to-peer network and is not controlled by any government or institution. Unlike fiat currencies, which can be printed at will, there will only ever be 21 million bitcoins in existence. This scarcity and decentralization has led some to believe that Bitcoin could become a global reserve currency.

El Salvador already adopted Bitcoin as legal tender and added it to government reserves. In addition, Argentina and Paraguay have used Bitcoin to settle export deals traditionally done in USD, Venezuela has turned to Bitcoin for domestic and global trade, Malaysian officials are trying to spark legislative action to adopt Bitcoin, Chile is introducing non-USD backed investment instruments to entice investors, and there are large movements allegedly underway in Central and South America to become crypto-friendly. Russia has also announced the acceptance of cryptocurrency for commodities in an attempt to further reduce its dependence on the dollar.

While China may be attempting to replace the US dollar with a Yuan central bank digital currency (CBDC), there are obvious drawbacks. In addition to the Orwellian nature of CBDCs, where government’s could cut off your access if you post something critical online or don’t confirm to their whims, CBDCs are just a digital version of current fiat money with no supply cap. Central banks can simply create as much of it as they like, which perpetuates inflationary risks. There is no scarcity and the centralization inevitably leads to abuse, corruption and an unfair advantage for those that can create it or are closest to its creation.

Bitcoin has digital scarcity and true decentralization, which is why many believe that it would be a superior world reserve currency. The protocol is not owned by anyone, it levels the economic playing field, prevent unfair concentration of wealth and has less of an impact in raising the strength of one country at the expense of another. Having a capped supply, governments would not be able to create infinite amounts to fund wars, buy influence, consolidate power, pay kickbacks and engage in their typical shady behavior.

The next Bitcoin halving is expected to occur in May 2024, reducing Bitcoin’s inflation rate to 1.8%, which is significantly lower than the average worldwide inflation rate. As adoption increases, this low inflation rate will translate into less volatility and a better store of wealth than fiat reserves. We could eliminate currency manipulation and governments blocking citizens’ access to their money, while operating a single shared global payment system. The Lightning Network would be ideal for the payment layer and hardware wallets could provide cold storage for those looking to save.

Some believe using a Bitcoin standard could create a fairer financial market for all nations, while reducing the wealth gap and incentivizing savings rather than consumption. Sound money provides a fertile environment for civilization to thrive and increase the standard of living. By contrast, the fractional reserve fiat monetary system allows for the concentration of wealth in the hands of a few, while rewarding corruption and centralizing power.

Bitcoin and gold might be able to work together to create a better monetary system based on scarce assets and sound money. I believe such a monetary system will lead to a more prosperous world and a smaller wealth gap. But those that benefit from the current system are unlikely to let go of the reins without a fight. And unfortunately they will resort to war or other drastic measures in order to continue with the status quo.

The addition of Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates to the BRICS alliance signifies a major power shift taking place. We are moving toward a more multi-polar world and a waning role for the U.S. dollar as it loses petrodollar status and world reserve status. This will negatively impact the standard of living for most people in the United States, but there are steps that investors can take to mitigate the impact, protect and even grow their wealth through this shift.

The simple solution is reducing exposure to U.S. dollars and increasing exposure to scarce assets such as gold, other commodities and Bitcoin. We also view mining stocks as being undervalued at the current time and think there are opportunities for leveraged gains in this sector.

At Nicoya Research, we track the macro landscape and deliver actionable insights for self-directed investors. We provide model portfolios, trade alerts, monthly newsletters and a chat room for subscribers and invite you will join us as we navigate the changing economic and political landscape.

Original Article: https://www.nxtmine.com/economics/brics-expansion-to-accelerate-decline-of-the-us-dollar/